who pays sales tax when selling a car privately in florida

But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. Florida law prohibits the parking of any vehicle on public right of ways or on private property for the purpose of sale without the permission of the property owner.

Car Tax By State Usa Manual Car Sales Tax Calculator

24000 is the advertised price minus the dealer incentive and trade-in allowance.

. Additionally Florida law presumes any person firm partnership or corporation that buys sells. However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in with a maximum tax rate of 15. Instead the buyer is responsible for paying any sale taxes.

If your trade-in is given a value by the dealership of 10k then you would only owe 1200 a savings of 600. Fully executed Form DR-123 must be signed at time of sale. To calculate how much sales tax youll owe simply multiple the vehicles price by 006625.

The buyer will have to pay the sales tax when they get the car registered under their name. Its illegal in Florida to sell a vehicle privately with an existing lien. The local surtax only applies to the 1st 5000.

20000 purchase price x 006 sales tax percentage 1200 sales tax owed. Thankfully the solution to this dilemma is pretty simple. For example a used car sold for 3000 the buyer can put down 2000 if he chose or 3000 the exact price.

According to the Florida Department of Highway Safety its best to complete the transaction at the tax collectors office. You would pay 23500 for the vehicle. Do I have to pay sales tax when I transfer my car title if the car was given to me.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. You will pay less sales tax when you trade in a car at the same time as buying a new one. You may voluntarily file and pay taxes electronically.

Based on this example you would need to pay 1440 in sales tax. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. This price does not factor in the manufacturers rebate.

Checklist for selling a vehicle. You will pay less. It will need to be complete and then filed with your local county tax collector office.

Doing so protects you from civil liability and other headaches that could occur if. The buyer will have to pay the sales tax when they get the car registered under. Under Florida state law the Florida Department of Revenue collects 6 sales tax on 28000 which is the advertised full purchase price of 30000 minus the 500 dealer discount and 1500 trade-in allowance but not minus the 3000 manufacturers rebate.

Ad Receive Car Selling Tips Pricing Updates New Used Car Reviews More. To sell the motor vehicle the lien first has to be satisfied. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

You pay 1680 in state sales tax 6. Expect to pay these fees to a motor vehicle service center when transferring ownership. Box 68597 Harrisburg PA 17106-8597.

This is generally referred to as curbstoning. Sales to someone from a state with sales tax less than Florida. You would not have to report this to the IRS.

Under the Sales Tax Exemption Certification section of the application the new owner is required to declare that the transfer of ownership is exempt from tax as a gift. Answer 1 of 14. I then asked him to fill in a sale price later.

Collect the buyers home state rate up to Florida 6. Car Sales Tax for Private Sales in Florida The buyer must pay the sales tax for a vehicle purchased from a private party. When I sold private owned cars A few times I gave the buyers the title and signed it.

When the sale of a motor vehicle to a resident of another state that imposes a sales tax of less than six percent and the purchaser takes possession of the vehicle in florida the purchasers home state tax rate is applied when. In Florida a vehicle cannot be legally sold in a private sale if there is an existing lien. You will pay less sales tax when you trade in a car at the same time as buying a new one.

If you buy a car for 30000 you would typically owe a six percent sales tax which comes to 1800. You pay 25000 for the new car saving you 5000. Visit the Departments Florida Sales and Use Tax webpage.

You do not need to pay sales tax when you are selling the vehicle. In this case Florida collects a 6 sales tax on 24000. Proof of Ownership Buyers should ask to see the title to verify VIN and.

Check that the VIN appears the same on the title certificate as it does on the vehicle. Who Pays Sales Tax When Selling A Car Privately In Florida. Once the buyer has the vehicle registered under his name he must pay to sell Texas.

Remember the sales price does not include sales tax or tag and title fees. Florida collects a 6 state sales tax rate on the purchase of all vehicles. Or private tag agency.

In Florida if you buy a 30k car you would owe 6 which is 1800. So if you bought the car for 14000 and sold it for 8000 you would have a capitol loss of 6000. The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document.

The license plate should be returned to PennDOT at Bureau of Motor Vehicles Return Tag Unit PO. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Answer 1 of 14.

If you sell more than two motor vehicles in any. The buyer must pay Florida sales tax when purchasing the temporary tag. An out-of-state dealer who does not have a Florida sales tax number buys a motor vehicle for resale or lease.

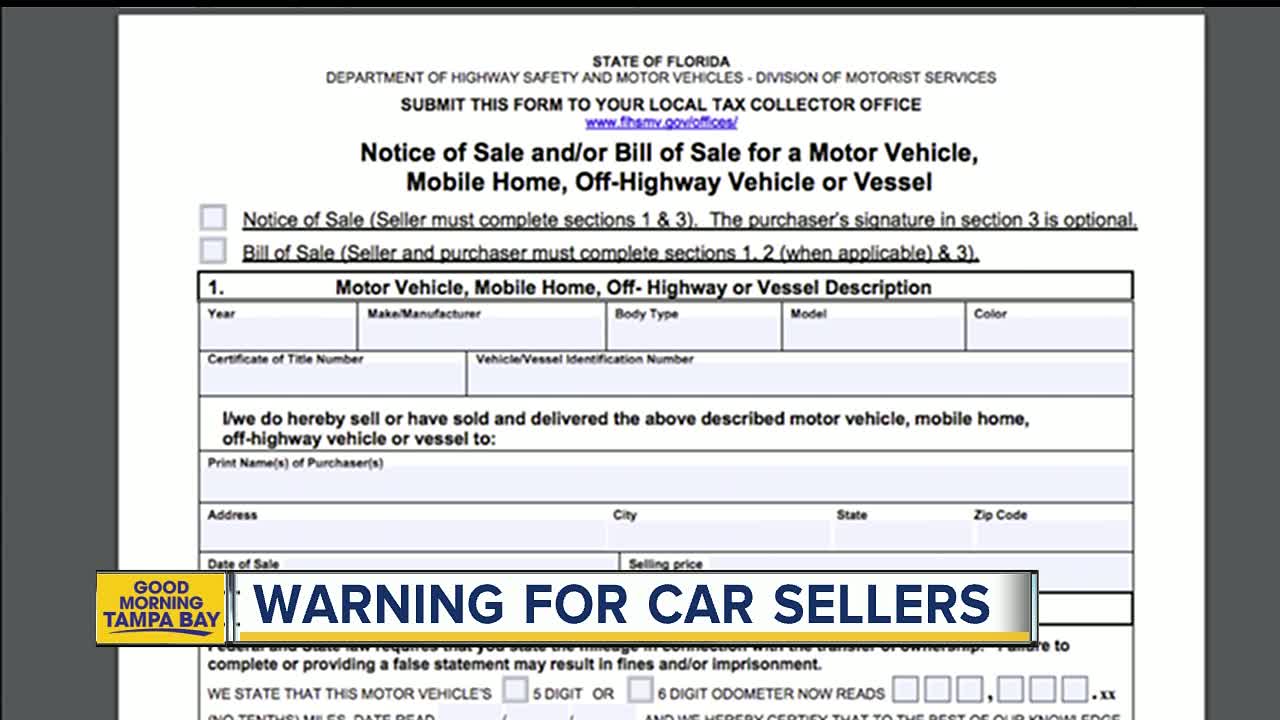

The local surtax only applies to the 1st 5000. Additionally Florida law presumes any person firm partnership or corporation that buys sells. The state bill of sale or Notice of Sale andor Bill of Sale for a Motor Vehicle Mobile Home Off-Highway Vehicle or Vessel Form HSMV 82050 can be downloaded and printed.

If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. It should be noted that the local tax is only applied to the first 5000 dollars of the cost of the vehicle. Thereafter only 6state tax rate applies.

However if you pay 20000 or more in sales and use tax between. No local surtax charged. Dealer to collect and report Florida sales and use tax.

Florida collects a 6 state sales tax rate on the purchase of all vehicles. This important information is crucial when youre selling. However if you bought it for 14000 and sold it for 15000 earning a 1000 capital gain you would report this on your tax return using Schedule D on Form 1040 thats appropriately titled.

After the title is transferred the seller must remove the license plate from the vehicle. If you get.

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Steps To Take Before Selling Your Car In Florida

How Much Tax Will I Have To Pay On A Car That S Worth 80 000 In Ca Quora

States That Allow Trade In Tax Credit

Car Tax By State Usa Manual Car Sales Tax Calculator

If A Car Is Sold Between Family Members Not A Gift Is There Still Sales Tax In California Quora

South Carolina Sales Tax On Cars Everything You Need To Know

Buying A Car Out Of State A How To Guide Lendingtree

Car Tax By State Usa Manual Car Sales Tax Calculator

Louisiana Car Sales Tax Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

How To Gift A Car A Step By Step Guide To Making This Big Purchase

States That Allow Trade In Tax Credit

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds